US Fed Meeting – September 2025 Outcome: What Happened & What It Means

On September 16–17, 2025, the US Federal Reserve’s Federal Open Market Committee (FOMC) held its latest meeting. With inflation still stubbornly above target, a cooling labor market, and growing concerns about economic growth, this meeting was watched closely by markets, businesses, and policymakers. Below is a breakdown of the decisions, forecasts, and implications.

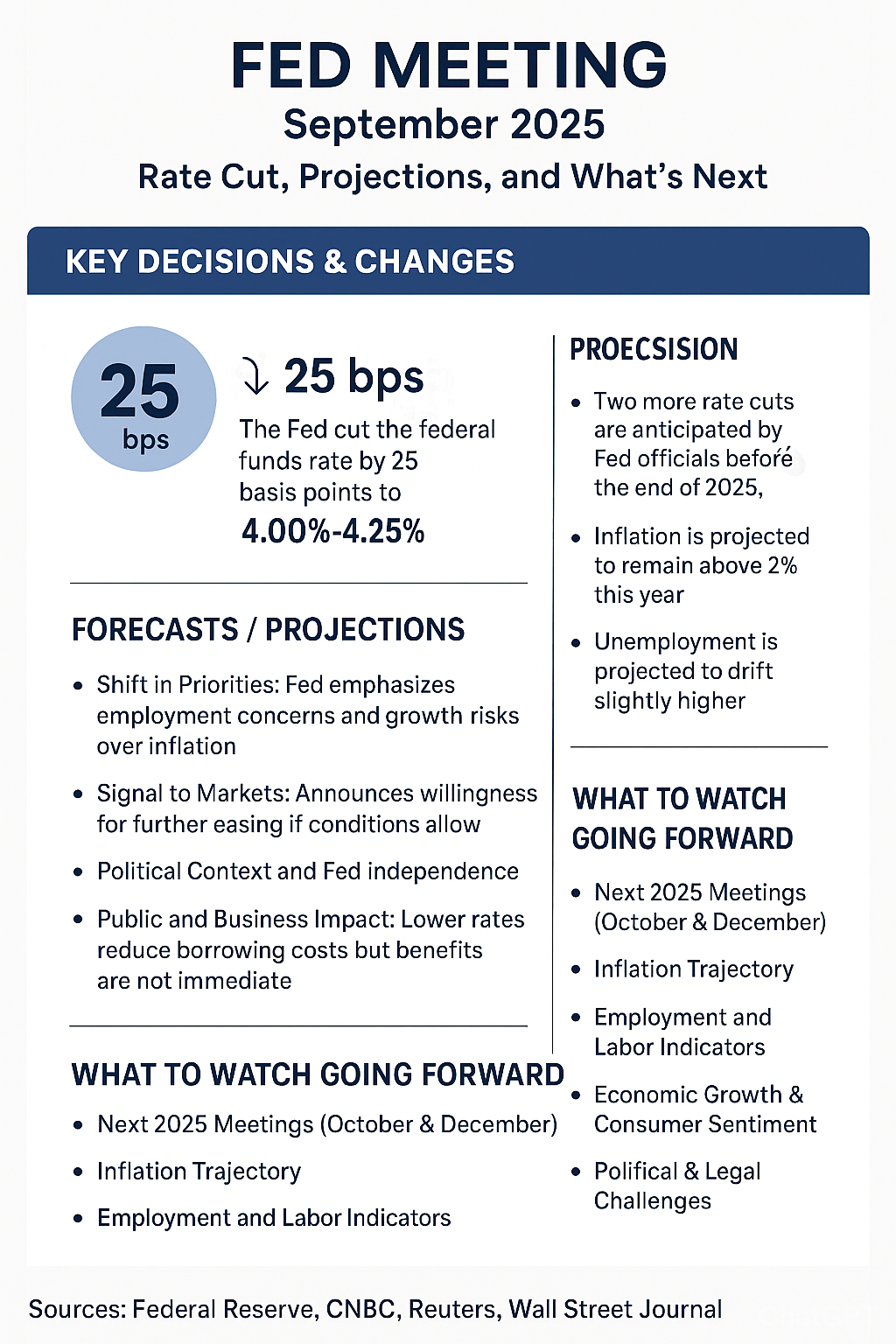

Key Decisions & Changes

- Interest Rate Cut:

- Forecasts / Projections (“Dot Plot”):

- Two more rate cuts are anticipated by Fed officials before the end of 2025. (Reuters)

- The Fed’s projections for inflation remain above the 2% goal for this year. Core PCE inflation is expected to be around 3.0% for 2025 and gradually move closer to target in 2026 and 2027. (Federal Reserve)

- Unemployment is projected to drift slightly higher, with the rate seen around 4.5% in 2025, before perhaps easing a bit in 2026. (Federal Reserve)

- GDP growth expectations were modest; real GDP growth for 2025 is forecast at about 1.6%, with slightly higher growth in 2026. (Federal Reserve)

- Dissent / Internal Differences:

- Labor Market & Inflation Signals:

- The Fed noted signs of a softening labor market: job growth has been slowing, and unemployment is edging up. (Reuters)

- Inflation remains above target, especially when excluding food and energy (core inflation). The Fed acknowledged that the pass-through effects from tariffs and trade policies have had a smaller and slower impact than previously projected. (Reuters)

Why This Meeting Was Significant

- Shift in Priorities: For much of 2025, the Fed held rates steady, emphasizing inflation control. With this cut, it’s clearer that employment concerns and growth risks are gaining weight in policy decisions. (Reuters)

- Signal to Markets: The announcement of further cuts signals the Fed’s willingness to ease monetary policy if economic conditions warrant. Investors will be monitoring upcoming data (jobs, inflation, consumer spending) especially closely.

- Political Context and Fed Independence: The rate cut and the framing of the outlook happened amid political pressures. There has been controversy over attempts to influence Fed personnel (like the bid to remove Governor Lisa Cook), and Stephen Miran’s confirmation adds another dimension to how policy voices may shift. (Reuters)

- Public and Business Impact: Lower rates typically reduce borrowing costs for mortgages, business loans, and credit, which can stimulate investment and consumer spending—but the lag in effect and concerns over inflation mean these benefits are not immediate.

What to Watch Going Forward

- Next 2025 Meetings (October & December): The Fed has indicated room for two more cuts this year. The magnitude of these will depend heavily on inflation data, labor market strength, and geopolitical disruptions. (Reuters)

- Inflation Trajectory: Whether inflation continues to fall toward 2%, especially core PCE inflation. If inflation remains persistent, it could lead to slower or more limited rate cuts.

- Employment and Labor Indicators: If job gains deteriorate further or unemployment rises sharply, the Fed may lean more dovish.

- Economic Growth & Consumer Sentiment: Weakening growth or consumer data (retail sales, industrial production, housing) could add urgency to monetary easing.

- Political & Legal Challenges: Legal cases (e.g., Cook v. Trump) and political pressures over Fed decisions and personnel could affect perceptions of Fed independence, which in turn influence longer-term credibility and market expectations. (Reuters)

Market Reactions & Risks

- Bond yields & dollar: After the announcement, U.S. Treasury yields adjusted modestly. The dollar saw mixed movement. (Reuters)

- Stock markets: Equities initially responded positively to the prospect of lower rates, particularly rate-sensitive sectors (real estate, consumer discretionary).

- Risk of overshoot: If the Fed cuts too quickly without inflation falling, there’s a risk of reigniting inflation pressures. Conversely, if cuts are too slow, economic slowdown could worsen.

✅ Summary

The Fed’s September 2025 meeting marked a turning point: after holding rates steady for much of the year, the Fed has begun easing policy with a quarter-point cut, flagged the possibility of more cuts, and made clear that concerns over growth and employment are now prominent. Inflation remains above target, but the Fed is preparing to act more flexibly, depending on incoming data.

For businesses and households, the message is to expect gradually easier credit conditions—but not immediately. The economy remains in a delicate balance between cooling inflation and sustaining employment. And in today’s environment, even small decisions by the Fed are under intense scrutiny.

Be First to Comment